Think the pandemic profit rush started in 2020? Buckle up. The latest Epstein document dump doesn’t just expose depraved parties—it unveils a two-decade financial and institutional blueprint where global health crises were pre-positioned as a managed business category. This article, inspired by Sayer Ji’s Substack, reveals how pandemics went from a public health threat to a pre-modeled, investable asset class for the world’s most powerful networks.

This isn’t about creating a virus. It’s about something arguably more systemic: creating the financial, legal, and narrative machinery to control and capitalize on it when it arrived. The players? A nexus of Wall Street banks (JPMorgan), philanthropic capital (Bill Gates), reinsurance giants (Swiss Re), and pharmaceutical behemoths (Merck), all facilitated by the most infamous convicted sex offender in modern history.

🔍 The “Questionnaire” That Revealed Who Was Really in Charge

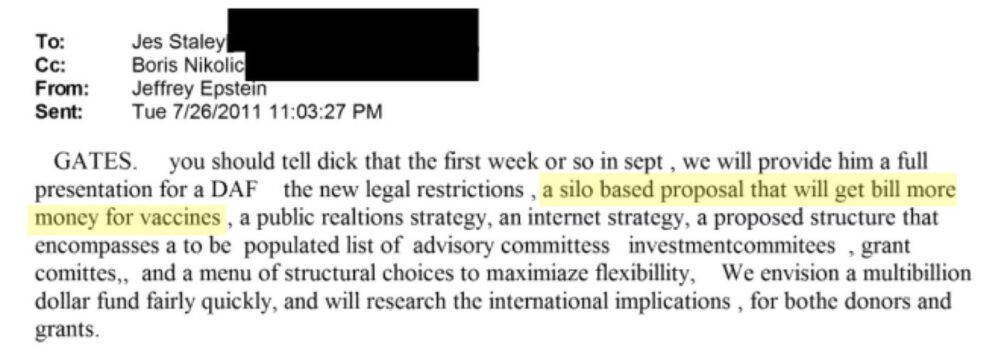

The story crystallizes in a chilling 2011 email exchange. Juliet Pullis, a JPMorgan executive under then-chairman Jes Staley, emailed Jeffrey Epstein with a list of detailed questions. The source? “The JPM team that is putting together some ideas for Gates.“

The questions were precise: What are the objectives? Is anonymity key? Who directs the investments and grants? This wasn’t JPMorgan consulting an expert; it was a trillion-dollar bank asking a convicted felon to architect a billion-dollar philanthropic fund for Bill Gates.

Epstein’s reply was fluent and commanding. He described a donor-advised fund with a “stellar board” and ties to the Gates-Buffett “Giving Pledge.” He noted the billions already pledged and identified the gap: “They all have a tax advisor, but have no real clue on how to give it away.” His solution? “JPM would be an integral part. Not advisor… operator, compliance.“ Staley’s response: “We need to talk.“

💉 The “Vaccine” Hook: The Sentence That Unlocks Everything

By July 2011, the plan evolved. In an email to Staley, copying Boris Nikolic (Gates’ chief science advisor), Epstein laid out the core pitch: “A silo based proposal that will get Bill more money for vaccines.”

Not “more research for pandemics.” Not “better public health infrastructure.” “More money for vaccines.” This is the unambiguous language of capital formation, not charity. It reveals the structure’s intended output planning reached the highest levels.

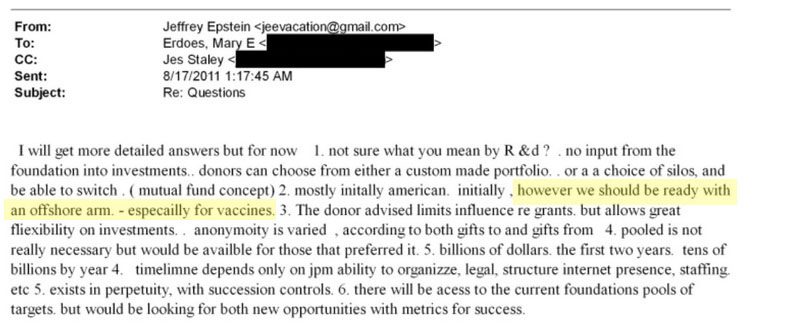

In August 2011, Mary Erdoes, CEO of JPMorgan’s $2+ trillion Asset & Wealth Management division, emailed Epstein (while on vacation) with additional operational questions. Epstein’s minutes-later reply was breathtaking in scope:

-

Scale: “Billions of dollars” in two years, “tens of billions by year 4.”

-

Structure: Donors choose from “silos” like mutual funds.

-

The Kicker: “However, we should be ready with an offshore arm — especially for vaccines.”

An offshore arm. For vaccines. For a charitable vehicle. Let that sink in.

🎭 The Core Contradiction: “The Tension Is Making Money from a Charitable Org”

In a follow-up email, Epstein laid bare the ethical rot at the center of this architecture. After detailing how investment management would be “farmed out” to JPMorgan’s hedge fund, Highbridge, he wrote this seminal line:

“The tension is making money from a Charitable Org. Therefore the money making parts need to be arms length.”

There it is. From the architect’s own mouth. The goal is profit, wrapped in the legal and tax-exempt cloak of charity. The solution isn’t to avoid profit, but to engineer “arm’s length” distance to maintain plausible deniability.

🧩 The Network Snapshots: Pandemics as Professional Currency

The documents show this wasn’t just theoretical finance; it was an operational network:

-

2017 Email: An Epstein-Gates-Nikolic thread explicitly lists “pandemic” as a “key area” for donor-advised fund structures.

-

2017 Text Message: An Epstein associate lists “pandemics (just did pandemic simulation)” as a credential while discussing job placements into Gates’ office, Merck’s vaccine team, and Swiss Re’s pandemic reinsurance unit. Simulation experience became a resume item for accessing the pandemic profit pipeline.

-

The Gates Foundation’s Own Funds: Their Global Health Investment Fund was pitched as an “impact investment” targeting 5-7% returns on drugs and vaccines, backed by a 60% principal guarantee from the US and German governments. Public risk, private reward.

⚖️ The Bottom Line: Preparedness vs. Pre-Positioned Profit

This is the critical distinction the article forces us to see:

-

Public Health Preparedness = A public good, reacting to a threat.

-

Pre-Positioned Profit Architecture = A private capture, anticipating the threat as a revenue event.

The evidence suggests that by the time COVID-19 emerged, the financial vehicles, legal structures, simulation playbooks, reinsurance products, and even the career pipelines to manage the crisis—and profit from its solution—were not just ideas. They were built, funded, and waiting in plain sight.

The pandemic wasn’t an interruption to their business model.

It was the triggering event for their business model.

================

Read Sayer’s full, meticulously-sourced investigation that connects these dots here:

BREAKING: The Epstein Files Illuminate a 20-Year Architecture Behind Pandemics as a Business Model

THANKS FOR ALL THAT YOU DO TO HELP PEOPLE, WITH THE INFORMATION TO KEEP THEM HEALTHY

Thank you for this information that explained how they did it, and further confirms what the various censored, alternative media had been saying (while searching for the evidence that proves the plots.) I pray all the truth will be revealed in ways that cannot be denied, and the multitudes of misled, misinformed masses will finally know the truth, so united we can and will stand together against such evil, and NEVER let it happen again. And PLEASE, (Dear God,) Have them ALL publicly tried and incarcerated for all their remaining earthly days!

The number one reason we are now aware of this is because the average American really doesn’t care. 50 years ago people went to jail not anymore.

What’s described there about Epstein, Gates etc al about vaxines and profits and the fact it was all worked out before 2019 is just horrific. It’s obscene and if there were laws they would be the first to be dealt with but it seems there are no laws for them.